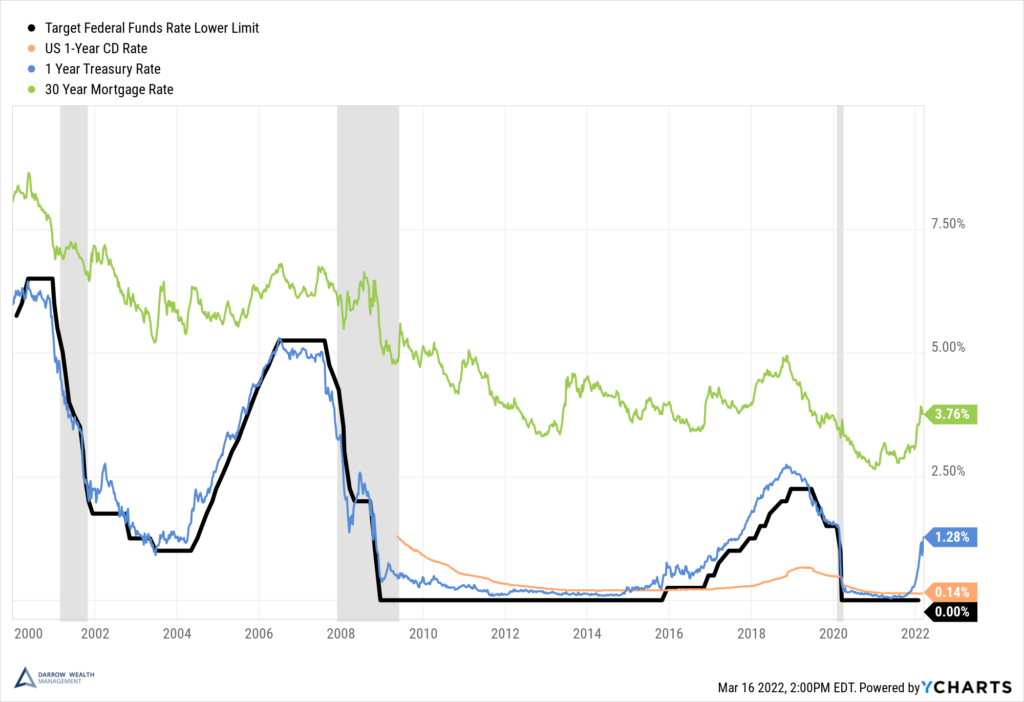

How mortgage rates move when the Federal Reserve meets | Mortgage Rates, Mortgage News and Strategy : The Mortgage Reports

Change in Trend? Seasonal Impact, Charting the S&P, Fed Minutes, Mortgage Rates - TheStreet's Real Money Pro

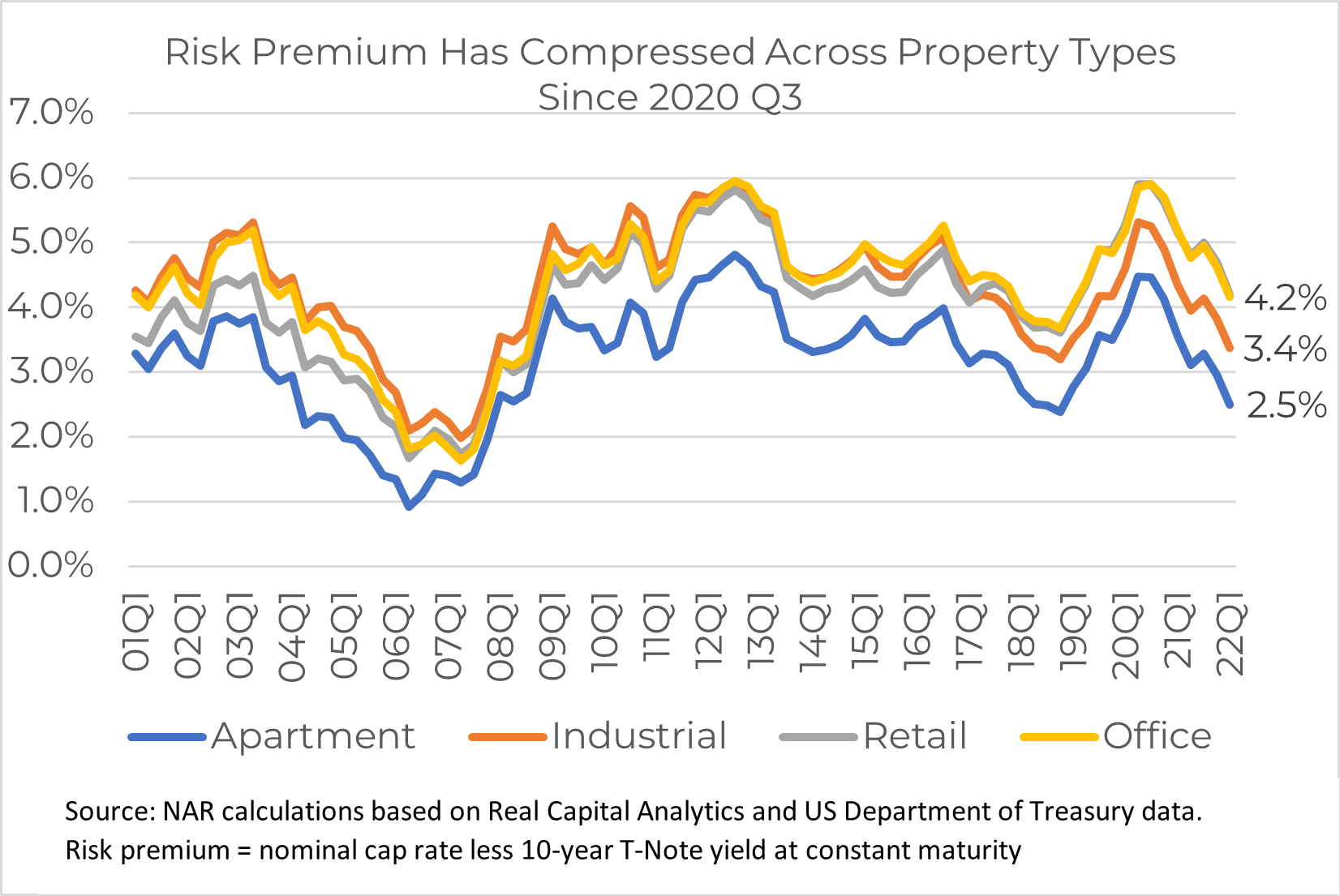

Mortgage Bankers Predict Mortgage Rates to Drop to 5.4% by End of 2023. A Year Ago, They Forecast 4% by Now, but Now We're at 7%. Wishful Thinking by Crushed Mortgage Lenders? | Wolf Street

Mortgage Bankers Predict Mortgage Rates to Drop to 5.4% by End of 2023. A Year Ago, They Forecast 4% by Now, but Now We're at 7%. Wishful Thinking by Crushed Mortgage Lenders? | Wolf Street

:max_bytes(150000):strip_icc()/DecemberMortageRatesNews-30-6507d0f82bcd4541a028f501162c9a88.jpg)